Tag Archive for: Educational Information

Mortgage Terms, Explained: No Jargon, Just Answers

Let’s be honest: the mortgage process can feel like learning a whole new language. Between acronyms, industry lingo, and legal-sounding terms, it’s easy to feel overwhelmed. That’s why we’re breaking it all down — no jargon, just clear answers — so you can feel confident every step of the way.

Whether you’re a first-time buyer or need a refresher, here are some common mortgage terms explained in plain language:

Pre-Approval

What it means: A lender reviews your financial information and tells you how much you can borrow.

Why it matters: It shows sellers you’re serious and ready to buy — like a permission slip to shop for a home.

Down Payment

What it means: The amount of money you pay upfront toward your home.

Why it matters: A higher down payment often means lower monthly payments and better loan terms.

Interest Rate

What it means: The cost of borrowing money from your lender, shown as a percentage.

Why it matters: Lower interest rates = less money paid over time. Your rate depends on your credit, loan type, and market conditions.

Rate Lock

What it means: A guarantee that your interest rate won’t change between pre-approval and closing, usually for a set time.

Why it matters: Protects you if rates go up before your loan is finalized.

APR (Annual Percentage Rate)

What it means: Your interest rate plus other loan-related fees, shown as a yearly percentage.

Why it matters: It helps you compare the total cost of different loans — not just the rate.

Loan Estimate

What it means: A document that outlines your loan details, including interest rate, monthly payment, and closing costs.

Why it matters: It helps you understand the full cost of your mortgage and compare offers from different lenders.

Escrow

What it means: An account where part of your monthly payment is set aside to cover property taxes and insurance.

Why it matters: It keeps you from getting hit with big bills all at once.

DTI (Debt-to-Income Ratio)

What it means: A comparison of your monthly debt to your income.

Why it matters: Lenders use it to see if you can afford a mortgage. Lower DTI = better approval odds.

Closing Costs

What it means: Fees paid at the end of the mortgage process (loan origination, title insurance, taxes, etc.).

Why it matters: Usually 2–5% of the home’s price, so it’s important to budget for them.

Underwriting

What it means: The lender’s process of verifying your financial info to approve the loan.

Why it matters: It’s the final review before the loan gets the green light!

Final Thoughts

Understanding mortgage terms shouldn’t feel like decoding a secret message. When you work with a lender who explains things clearly and honestly (like us!), you’ll feel empowered — not overwhelmed.

Still have questions? We’ve got answers.

Reach out anytime — we’re here to make the mortgage process simple, clear, and stress-free from start to finish.

The Mortgage Paperwork Checklist: What You Need and Why

Buying a home is an exciting journey, but if there’s one part that can feel overwhelming, it’s the paperwork. From pay stubs to tax returns, lenders ask for a lot of information to make sure they fully understand your financial situation before approving your loan.

But don’t worry! With a little preparation and organization, you can keep the process smooth and stress-free. Let’s break down the essential documents you’ll need, why they matter, and how to stay on top of it all.

Income and Employment Verification

What you’ll need:

- Recent pay stubs (usually the last 30 days)

- W-2 forms from the past two years

- Tax returns (especially if you’re self-employed)

- Year-to-date profit and loss statements (for business owners)

Why it matters:

Lenders want to verify that you have a steady, reliable source of income to comfortably cover your future mortgage payments. If you’re self-employed or have multiple income streams, expect to provide additional supporting documents to show consistent earnings.

Asset Statements

What you’ll need:

- Recent bank statements (checking and savings accounts)

- Retirement or investment account statements

Why it matters:

These documents prove that you have enough money for the down payment, closing costs, and reserves if required. They also help your lender see if there are any large deposits or unusual activity that needs to be explained.

Debt and Liability Information

What you’ll need:

- Monthly statements for credit cards, auto loans, student loans, or other debts

- Documentation for any alimony or child support obligations (if applicable)

Why it matters:

Lenders use your debt information to calculate your debt-to-income (DTI) ratio, a key factor in determining how much you can safely borrow.

Identification and Personal Documentation

What you’ll need:

- A government-issued photo ID (driver’s license or passport)

- Social Security number (or documentation for alternative identification, if applicable)

Why it matters:

These items help confirm your identity and protect against fraud.

Other Possible Documents

Depending on your unique financial situation, lenders may also request:

- Divorce decrees

- Gift letters (if part of your down payment is a gift from family)

- Rental history or current lease agreement

- Proof of additional income, like bonuses or commissions

How to Stay Organized

A big part of speeding up the mortgage process is being organized from the start. Here are a few tips:

- Create a dedicated folder (digital or physical): Keep all requested documents in one place so they’re easy to access.

- Respond quickly: The faster you provide updated documents, the smoother (and faster!) your process will go.

- Ask questions: If you’re unsure why something is needed, don’t hesitate to ask your lender. A great lending team will always be happy to explain.

Final Thoughts

While the paperwork can feel daunting, each document plays an important role in helping your lender understand your financial picture and secure the best possible loan for you. Being prepared not only reduces stress but can also help you get to closing day even faster.

At Michigan Mortgage, we’re here to guide you through every step, including that stack of paperwork.

Ready to get started? Let’s make your homeownership journey as smooth as possible.

Why Is the Mortgage Process So Long?

Understanding the timeline, what’s happening behind the scenes, and how you can help speed things up.

Buying a home is exciting, but if you’ve ever felt like the mortgage process drags on forever, you’re not alone. Many buyers are surprised at how much time it takes between applying for a loan and finally closing on their dream home.

So… why does it take so long? Let’s pull back the curtain on the mortgage process and give you some helpful tips to keep things moving.

The Typical Mortgage Timeline

While every loan is different, the average mortgage process takes around 30–45 days from application to closing. Some may wrap up sooner, while others take longer depending on several factors.

Here’s a general breakdown of the timeline:

-

Pre-Approval (1–3 Days)

A lender reviews your financials and provides a letter showing how much you’re qualified to borrow.

-

House Hunting (Varies)

This part is totally in your hands! Some buyers find “the one” quickly, while others take weeks or months.

-

Loan Application (1–3 Days)

Once you have an accepted offer, you’ll complete a full mortgage application and provide detailed financial documents.

-

Processing & Underwriting (1–3 Weeks)

Behind the scenes, the lender reviews everything: income, credit, assets, tax returns, employment, and more.

The underwriter ensures the loan meets guidelines and may request additional info (called “conditions”). -

Appraisal & Inspection (1–2 Weeks)

An appraisal ensures the home’s value matches the loan amount. Inspections (while optional) protect you from surprises.

-

Final Approval & Closing (1–2 Weeks)

After all documents and conditions are cleared, you’ll get a clear-to-close. Then comes the final walkthrough and closing day!

What’s Taking So Long?

It may seem slow, but a lot is happening behind the scenes:

- Verifying Documents: Lenders must carefully check pay stubs, tax returns, bank statements, and more.

- Third-Party Delays: Appraisers, inspectors, title companies, and insurance providers are all integral to the process, and each has its own specific timeline.

- Regulations: Mortgage lending is highly regulated to protect buyers, but that also means more boxes to check.

- Loan Volume: During busy seasons, such as spring and summer, processing times may be longer due to high demand.

How You Can Help Speed Things Up

Good news — there are a few things you can do to help your mortgage process move faster and smoother:

-

Get Pre-Approved Early

Know your budget and streamline the process once you find a home.

-

Respond Quickly

When your lender requests documents or signatures, the faster you reply, the faster things move.

-

Stay Financially Stable

Avoid big purchases, job changes, or new credit applications during the process.

-

Keep Documents Organized

Have your W-2s, tax returns, bank statements, and ID ready to go.

-

Work With a Responsive Lender

Partnering with a proactive, communicative mortgage team (like ours!) can make all the difference.

Final Thoughts

Yes, the mortgage process can feel long, but that’s because your lender is working hard to make sure your loan is rock-solid. With a little preparation, the right mindset, and the right team, you can make it through with fewer delays and less stress.

At Michigan Mortgage, we walk with you every step of the way — keeping you informed, on track, and moving toward the keys to your new home.

Ready to start your mortgage journey?

Let’s talk! Our friendly loan experts are here to guide you from pre-approval to closing day and beyond.

How Your Credit Score Impacts the Home-Buying Process

Your credit score plays a crucial role in the home-buying journey. Whether you’re just beginning to think about purchasing a home or already shopping for mortgage options, understanding how your credit impacts the process can help you plan ahead and secure the best possible deal.

Why Credit Scores Matter

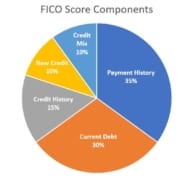

Mortgage lenders use your credit score to evaluate how likely you are to repay your loan. The higher your score, the more favorable your terms will likely be. Here’s how your credit score can affect the process.

-

Loan Approval: Most lenders require a minimum credit score to qualify for a mortgage. Conventional loans often require at least a 620, while FHA loans may accept scores as low as 580.

-

Interest Rates: A higher credit score usually results in a lower interest rate, which can save you thousands over the life of your loan.

-

Loan Programs: Some government-backed loans or first-time homebuyer programs may only be available to borrowers with certain credit thresholds.

-

Private Mortgage Insurance (PMI): If your credit score is lower, you may pay higher PMI premiums if you put down less than 20%.

Tips to Improve Your Credit Score

Improving your credit score can take time, but small, consistent steps can make a big difference.

-

Check Your Credit Reports: Review your reports from all three major bureaus (Experian, Equifax, and TransUnion) to ensure there are no errors or outdated information.

-

Pay Bills on Time: Payment history makes up a large portion of your score. Set reminders or automate payments to avoid late fees.

-

Reduce Credit Card Balances: Keep your credit utilization below 30% of your available limit. Paying down high balances can quickly boost your score.

-

Avoid Opening New Accounts: Each new account triggers a credit inquiry, which can slightly lower your score. Hold off on opening new credit lines during the mortgage process.

-

Keep Old Accounts Open: The length of your credit history affects your score. Don’t close old cards, even if you don’t use them often.

Final Thought

Your credit score can open doors — or create obstacles — in the home-buying process. By taking control of your credit now, you’ll be in a stronger position when you’re ready to make an offer on your dream home.

Need help understanding how your credit score affects your mortgage options? Reach out — we’re here to guide you every step of the way!

5 Things to Look for When Buying a Home in the Summer

Summer is one of the most exciting times to buy a home in Michigan. The weather is beautiful, school’s out, and more homes are typically available on the market. But while summer brings opportunity, it also comes with a few unique considerations.

At Michigan Mortgage, we’re here to help you navigate the process with confidence. Before you dive into house hunting, here are five key things to look for when buying a home in the summer.

1. Watch for Seasonal Competition

Summer is peak home-buying season, which means more competition. With more buyers shopping at the same time, homes can sell quickly — sometimes with multiple offers.

What You Can Do:

Get pre-approved before you start your search. It strengthens your offer and shows sellers you’re serious.

2. Consider Cooling and Energy Costs

A home may look perfect on a sunny day, but make sure you ask about how well it stays cool in the heat. Michigan summers can be humid, and an outdated cooling system could mean higher utility bills.

Things to ask about:

- Age and condition of the A/C unit

- Quality of insulation (especially in the attic)

- Average summer utility costs

3. Check the Roof, Windows, and Landscaping

Summer weather makes it easier to spot issues outside the home. Look for signs of wear on the roof, windows, siding, and driveway. You’ll also want to check for drainage or grading problems after it rains.

Pro Tip:

If possible, schedule your inspection after a storm to reveal any leaks, pooling water, or foundation concerns.

4. Think About Timing

Buying in the summer often means trying to move before the school year starts or before Michigan’s winter weather returns. Factor in the closing timeline, moving logistics, and any necessary home repairs or updates.

The Good News:

We work hard to ensure your loan closes on time — so you can enjoy your new home without delays.

5. Picture Your Life There — All Year Long

It’s easy to fall in love with a home in the summer sunshine, but don’t forget to think long-term. Ask yourself how the home—and the neighborhood — will fit your lifestyle year-round.

Consider:

- Winter commute and snow removal

- Local school and work traffic

- Access to main roads and necessities in bad weather

Ready to Buy This Summer?

We’re Ready to Help.

Buying a home during the summer can be exciting and efficient with the right support. At Michigan Mortgage, we specialize in helping buyers throughout Michigan find the right loan and close with confidence.

Call us today to get started — or apply online anytime.

Let’s make this your best summer yet.

MSHDA Increases Sales Price Limit – What Does That Mean for You?

Michigan homebuyers, take note — big changes are coming that could make purchasing a home more achievable than ever. Beginning in May 2025, the Michigan State Housing Development Authority (MSHDA) will raise its maximum sales price limit for the first time in over 16 years. Thanks to the passage of HB 5032, this update opens new doors for buyers across the state.

Here’s what you need to know — and how this change could work in your favor.

What’s Changing?

Higher Sales Price Limits

MSHDA’s new guidelines will increase the maximum sales price for eligible single-family homes from $224,500 to $544,233. This significant jump gives homebuyers access to a broader range of properties throughout Michigan, including many that were previously out of reach.

Expanded Eligibility

MSHDA programs have historically been geared toward first-time homebuyers, but that’s changing. Beginning next May, repeat buyers will also be eligible for MSHDA assistance in 82 percent of Michigan counties. This expansion means more buyers, regardless of where they are in their homeownership journey, will be able to take advantage of MSHDA programs.

Flexible Loan Compatibility

MSHDA programs can be paired with a variety of popular loan types, including Conventional, FHA, VA, and RD (Rural Development) loans. This added flexibility allows more buyers to find financing solutions tailored to their specific needs.

Need more information? Fill out this form and our team will be in touch soon!

How This Helps You

Access to More Inventory

The increased price cap opens the door to a larger pool of available homes — giving you more options in more locations and helping you find a home that truly fits your lifestyle and budget.

Up to $10,000 in Down Payment Assistance

MSHDA’s MI Home Loan DPA program offers up to $10,000 to help cover your down payment and closing costs. This can be a game-changer for buyers looking to make a competitive offer without depleting their savings.

Ongoing Tax Savings

Through MSHDA’s Mortgage Credit Certificate (MCC) program, eligible buyers can receive a federal tax credit worth up to $2,000 annually, based on mortgage interest paid. This benefit boosts affordability and adds value for years to come.

Simple, Streamlined Financing

Because MSHDA works seamlessly with a range of loan types, the financing process remains straightforward. And when you work with an experienced lender like Michigan Mortgage, you have a trusted partner guiding you through every step.

What Should You Do Now?

Start Looking at Homes

Explore neighborhoods and listings that will fall within the new sales price limits. With more homes potentially in reach, it’s a great time to refine your search.

Reach Out to Michigan Mortgage

Our team is well-versed in MSHDA programs and how they work. We can help you navigate the changes, understand your eligibility, and secure the right loan for your needs.

Stay Updated

The new sales price limits are expected to take effect in May 2025, once HUD releases updated income guidelines and the IRS announces new safe harbor limits in April. We’ll keep you informed with everything you need to know as the changes roll out.

Final Thoughts

MSHDA’s updated guidelines represent a major win for Michigan homebuyers. Whether you’re purchasing your first home or transitioning to your next, the increased sales price limits and expanded eligibility open the door to more opportunity — and more homes.

At Michigan Mortgage, we’re committed to helping you make the most of it. If you’re ready to learn more or begin your home search, contact us today. We’re here to help you move forward with confidence!

Funds Still Available for MSHDA’s $25,000 DPA Program

For many first-time homebuyers, saving for a down payment is one of the biggest challenges to homeownership. The Michigan State Housing Development Authority (MSHDA) is making it easier with the First-Generation Down Payment Assistance Program, which provides up to $25,000 to qualified buyers.

With only $8 million in available funding, this is a limited opportunity (some of those funds have already been used!). Once the funds are gone, they’re gone. If you or someone you know is looking to buy a home, now is the time to act.

What is the First-Generation Down Payment Assistance Program?

This program is designed to help first-generation homebuyers — those whose parents have not owned a home in the past three years — get the financial support they need to purchase a home. The $25,000 assistance can be used for a down payment, closing costs, prepaid expenses, and escrows.

For many buyers, this program eliminates the biggest barrier to homeownership, making it possible to secure a home with significantly less out-of-pocket expense.

Who Qualifies?

To be eligible for this down payment assistance, buyers must:

- Purchase the home as their primary residence

- Not have owned a home in the last three years

- Have parents who have not owned a home in the last three years

Additionally, at least one of the following must apply:

- Parents have not owned a home in the last three years

- Buyer has aged out of foster care

- Buyer has been emancipated

How to Get Started

Since funding is limited, it’s important to act quickly. Here’s what buyers need to do:

- Get pre-approved – A Michigan Mortgage Loan Officer can help determine eligibility, assess financial readiness, and guide buyers through the process.

- Complete the required Homebuyer Education Course – All buyers using MSHDA down payment assistance must take this course to qualify.

- Find the right home – Once pre-approved, buyers can begin their home search with the confidence that they have financial support in place.

Why This Program Matters

Homeownership is a major milestone, but for many first-generation buyers, it has felt out of reach. This program helps level the playing field, providing financial support to those who may not have had generational assistance in buying a home.

By reducing the upfront costs, MSHDA is making homeownership more accessible for individuals and families who are ready to make the move.

For more details, give us a call and take the next step toward owning your first home!

First-Time Homebuyer Loan Options with Michigan Mortgage

Buying your first home is an exciting milestone, but navigating the mortgage process can feel overwhelming. The good news? There are several loan programs designed specifically for first-time homebuyers, many of which offer flexible credit requirements, low down payments, and even financial assistance. At Michigan Mortgage, we specialize in helping first-time buyers understand their options and find the best loan to fit their needs.

FHA Loans – A Great Option for Buyers with Limited Credit

FHA loans are backed by the Federal Housing Administration and are a popular choice for first-time homebuyers. This loan is especially beneficial for those with less-than-perfect credit, as it has more lenient credit requirements compared to conventional loans. One of the biggest advantages of an FHA loan is the low down payment — just 3.5% of the purchase price — making homeownership more accessible.

VA Loans – Exclusive Benefits for Veterans

For military veterans and surviving spouses, VA loans provide an excellent path to homeownership. These loans are backed by the Department of Veterans Affairs and offer significant advantages, including no required down payment and flexible credit requirements. VA loans are one of the best options available for those who qualify, making it easier for service members to achieve their homeownership goals.

USDA Loans – A Zero Down Payment Option for Rural Buyers

If you’re considering buying a home in a more rural area, a USDA loan could be a great fit. Backed by the U.S. Department of Agriculture, USDA loans are available to well-qualified buyers looking to purchase outside of major metropolitan areas. One of the biggest perks? No down payment is required, making this loan an excellent option for buyers who may not have significant savings but want to achieve homeownership in a more affordable location.

Conventional Loans – Ideal for Buyers with Strong Credit

Unlike government-backed loans, conventional loans are provided by private lenders and often require a higher credit score. However, they come with the advantage of lower mortgage insurance costs and flexible loan terms. With a down payment as low as 3%, conventional loans can be a great option for buyers with solid credit who want more flexibility in their financing.

Down Payment Assistance Programs

For first-time buyers who need additional financial support, there are programs that offer down payment assistance, subsidized interest rates, and even grant opportunities. These programs can help lower the upfront costs of purchasing a home, making it easier for buyers to get into their first home without exhausting their savings.

At Michigan Mortgage, we specialize in guiding first-time homebuyers through the process, ensuring they understand their loan options and have the support they need from application to closing. Whether you’re just starting to explore homeownership or ready to buy, our team is here to help. Contact us today to find out which loan option is right for you!