Could an FHA loan be the loan for you?

What is an FHA loan?

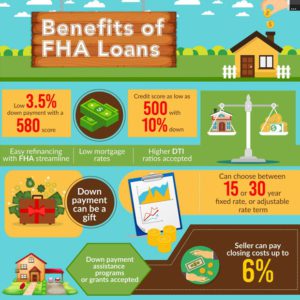

Photo Source: https://thelendersnetwork.com/fha-loan/

FHA stands for the Federal Housing Administration, which is a government agency. The FHA was created by the Housing and Urban Development Department (HUD) to increase homeownership in the U.S.

This loan was designed to allow more home buyers to qualify for home loans by allowing for lower credit scores and lower down payment requirements. FHA loans only require 3.5 percent down payment and in some circumstances, allow for credit scores as low as 580. The borrowers are required to pay mortgage insurance monthly (calculated at .85 percent of the loan amount) as post of the total payment.

FHA Credit Score Requirements

To qualify for a loan, the FHA may allow for credit scores under 580, but the borrower typically has to put more money down as most lenders do not wish to assume the risk, especially after the housing crisis of 2008. If your credit score is below 580, it is highly recommended that you improve your credit score before applying for a mortgage.

Who are candidates for FHA loans?

- Borrowers with a low credit rating

- Borrowers that cannot afford a large down payment

- Borrowers using a gift for a down payment

- Borrowers with high debt-to-income ratios

- First time home buyers

Down Payment Requirements

Perhaps the most significant benefits of an FHA loan is the 3.5 percent down payment requirement. Many conventional programs require down payments ranging from 5 percent to as high as 20 percent.

As an example, if you are purchasing a $200,000 home, a private loan will require no less than 5 percent down, or $10,000. With an FHA loan, at 3.5 percent down, the down payment would be $7,000 for a $200,000 home.

Each home buyer has a unique set of circumstances that impacts the type of loan that will be best. Make sure you work with a local lender that spends the time to educate you so you are able to choose the best loan for your situation.

Thanks for explaining how FHA loans are meant to help more buyers qualify and pay for a new home and they require borrowers to pay mortgage insurance monthly. If someone is thinking about buying a new house, it would probably be a good idea to contact a company that offers FHA home loans. This could give them the opportunity to discuss their situation and ask questions so they can figure out whether this payment option would be best to help them buy their house.

I wanted to thank you for mentioning that first time home buyers are people who can qualify for an FHA mortgage loan. It seems like this kind of loan would be good for college students that are currently in school or have recently graduated. I have a sibling that is looking into potentially purchasing a home soon, so I’ll have to tell them to do some more research on FHA mortgage loans.