10 Things to Do Before You Buy a House

Are you ready to start shopping for your first home? Before you begin, take a look at these 10 tips to make your home-buying journey successful!

Few things are as exciting as making a real estate purchase – and few things cause more stress! To help you out, we’ve compiled a list of 10 tips to help you navigate the process of buying your first (or second, or third) home. These won’t just reduce some of the anxiety, they’ll also help you avoid costly mistakes!

10 Tips for New Home-Buyers

- Know where and why you want to buy. The answers to these questions will help you understand what factors should be most important in your decision. For example, is your choice of neighborhood determined by your work, being close to family, or just that you fell in love with the area? Is this going to be a starter house that you’ll want to upgrade in a few years, or are you in for the long haul? Clarity here will help you make a purchase that’s in tune with the other parts of your life.

- Give yourself a financial health checkup. Start saving and paying off as many outstanding bills as you can. Check your credit report and get any errors removed. If you do this now, you’ll have a better understanding of what your budget really is – and a jumpstart on the mortgage preapproval process.

- Research neighborhoods, prices, real estate agents, and mortgage lenders. While the first two are a given, doing your homework on real estate agents and mortgage lenders is just as important.

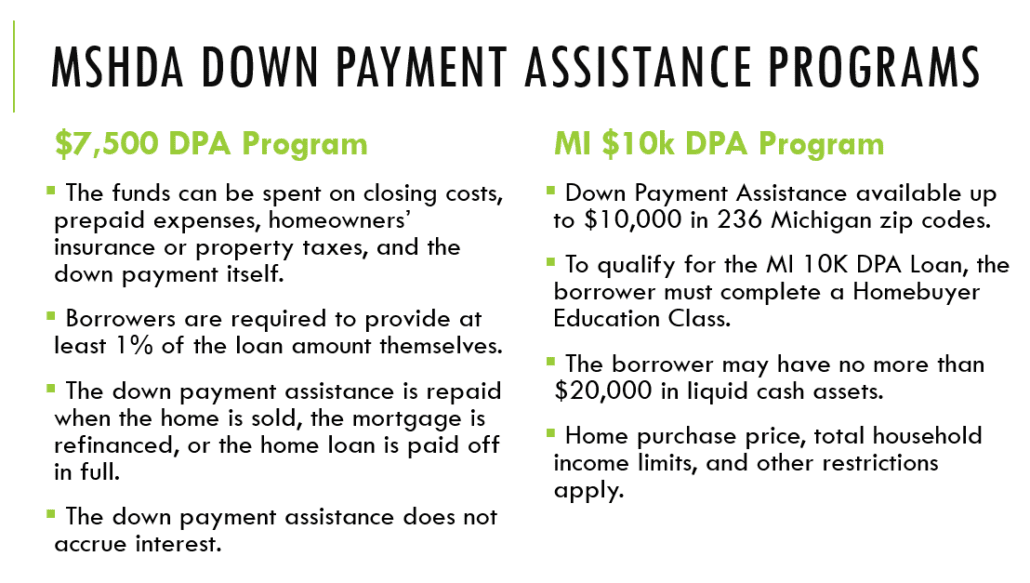

- Plan your budget and down payment. Once you’ve gotten a clear idea of your financial status, figure out how much home you can afford and how much of a down payment you’ll need – and can manage. Hint: Down payment assistance is often available through state and other agencies.

- Understand how the mortgage and home-buying process works. We’ve covered this quite a lot in this blog. See our posts on mortgage underwriting and the path to home ownership for more details.

- Get pre-approved. We’ve covered mortgage pre-approval and why it’s so important elsewhere in this blog. Suffice it to say that you can make a stronger offer on a home when your mortgage is pre-approved.

- Prepare yourself mentally and emotionally. This is a very hot real estate market. Competition is intense, so be prepared to deal with sticker shock and maybe some disappointment if some other buyer beats you to a house. Be flexible and don’t give up. And know that it’s not just you; most home-shoppers are dealing with the same things.

- Review mortgage paperwork and requirements. Yes, there are mortgage professionals who will be reviewing these documents. But look them over yourself; not only will you be legally committing yourself to the terms, any mistakes you correct now will mean one fewer potential snag later.

- Verify all information in the listing. Make sure the house you are purchasing is all that the sellers claim. Make sure all the features and amenities, all the room sizes, are as advertised.

- Get a home inspection. This is different from a home appraisal, which is mostly about verifying the value of the house and any property. A home inspection looks for potentially costly building, health, and safety issues, and you don’t want to skip that.

Finally, remember that the mortgage provider you choose will have a big impact on your decision. Make sure you’re working with one like Michigan Mortgage that will help you explore all your lending options and choose the one that’s right for you!

Let’s assume a home is being sold for $300,000 and the buyer is putting 5% down. To attract more buyers, the seller has agreed to pay $6,100 toward a 2-1 Buydown. If the current market rate is 5.5% then the buyer’s payment for the first 12 months would be at 3.5% or $1,279/month. For the second year, the payment would be based on a rate of 4.5% or $1,444/month. Starting in the third year, the buyer’s payment would be at 5.5% for the remaining 28 years or $1,618/month.

Let’s assume a home is being sold for $300,000 and the buyer is putting 5% down. To attract more buyers, the seller has agreed to pay $6,100 toward a 2-1 Buydown. If the current market rate is 5.5% then the buyer’s payment for the first 12 months would be at 3.5% or $1,279/month. For the second year, the payment would be based on a rate of 4.5% or $1,444/month. Starting in the third year, the buyer’s payment would be at 5.5% for the remaining 28 years or $1,618/month.

In the past, Reverse Mortgages were viewed in a negative light. That’s changing! There are many benefits to a Reverse Mortgage that consumers are unaware of.

In the past, Reverse Mortgages were viewed in a negative light. That’s changing! There are many benefits to a Reverse Mortgage that consumers are unaware of.

Here are 5 reasons to choose a local mortgage lender like Michigan Mortgage.

Here are 5 reasons to choose a local mortgage lender like Michigan Mortgage.

You can enter the market sooner. In today’s market, it’s all about speed and strength. Having a co-borrower added to your mortgage application can increase your buying power and help you enter the competitive market with your best foot forward.

You can enter the market sooner. In today’s market, it’s all about speed and strength. Having a co-borrower added to your mortgage application can increase your buying power and help you enter the competitive market with your best foot forward.

Buying or selling a home is a big decision, one of the most financially impactful you’ll ever make. A little expert guidance would be very helpful – but how can you find an expert you can trust? One who’s both knowledgeable and ready to look out for your best interests? It’s all down to choosing the right realtor.

Buying or selling a home is a big decision, one of the most financially impactful you’ll ever make. A little expert guidance would be very helpful – but how can you find an expert you can trust? One who’s both knowledgeable and ready to look out for your best interests? It’s all down to choosing the right realtor.

We can finance condominiums, single family homes and modular homes.

We can finance condominiums, single family homes and modular homes.

Before Applying for a Mortgage

Before Applying for a Mortgage