Who’s responsible for paying closing costs?

More often than not, buyers and sellers are responsible for covering the costs of their respective closings.

Buyers can expect to pay 3 – 6% of the loan amount in closing costs. Sellers, on the other hand, typically pay 5 – 6% of the sale price to their Realtor.

But that’s not always the case. Here are a few ways buyers can get someone else to help pay their closing costs.

Seller Concessions

Buyers can sometimes avoid paying closing costs (or at least a portion of them) if they ask the sellers to pay them instead. This is called seller concessions.

Each loan program is different, as shown below.

- Conventional: Up to 3% of the home’s value with a down payment of less than 10%. Up to 6% with a down payment of 10 – 25%.

- FHA: Up to 6% of the home’s value.

- VA: Up to 4% of the home’s value (there are some exceptions to this rule).

- RD: Up to 6% of the home’s value.

In today’s competitive market, this may not be your best option, as sellers are hoping to net as much as possible when closing on the sale of their home. Your Loan Officer will explore all options and help guide you in the right direction.

Gift Funds

Financial gifts from loved ones can be used to fund your down payment and closing costs. In most cases, a “loved one” is defined as a family member, fiancé, or domestic partner.

Gift funds must be properly sourced and documented to avoid hiccups during the underwriting process. The gift must include a letter that states the funds don’t have to be repaid by the buyer.

For more information, reach out to your Michigan Mortgage Loan Officer.

Down Payment Assistance Programs

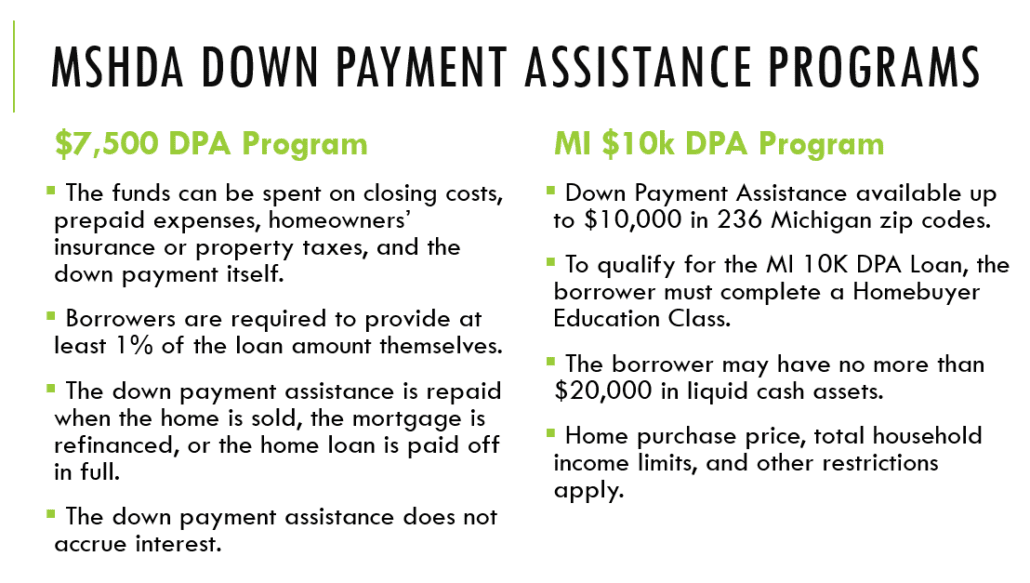

Are you familiar with the Michigan State Housing Development Authority, otherwise known as MSHDA?

MSHDA offers a variety of down payment assistance programs to help buyers purchase their forever homes. Each program is different, but here are a few general MSHDA guidelines.

Michigan Mortgage has been named the No. 1 MSHDA Lender in Michigan (and West Michigan) since 2016. There are many MSHDA misconceptions in our marketplace – it’s a hard program to master. But our knowledge and expertise has set us apart from our competition.

We recommend that you explore all options with your Loan Officer before writing an offer. Give us a call if you have questions! We’re here to help in any way we can.