For first-time buyers, the mortgage process raises a lot of questions. In part two of this series, we tackle some more of the most common questions we receive from customers.

For first-time buyers, the mortgage process raises a lot of questions. In part two of this series, we tackle some more of the most common questions we receive from customers.

“How Much Should I Save for a Down Payment?“

The exact dollar amount you should save for a down payment depends on the price of the house you are buying. Most down payment requirements are expressed in percentages. A 5% down payment on a $500,000 house is much greater in raw dollars ($25,000) than 5% on a $200,000 house ($10,000).

In terms of the minimum requirements for different loan types:

- For USDA or VA loans, no down payment is required.

- For FHA loans, the minimum down payment is 3.5%.

- For FannieMae HomeReady loans, the down payment is 3%.

- On a conventional loan, the minimum down payment will be somewhere between 3% and 5% of the purchase price. Be aware, however, that you will have to pay private mortgage insurance (PMI) if your down payment is less than 20% of the purchase price.

“What Will My Monthly Payment Look Like?“

A mortgage payment consists of two components:

The principal portion goes toward paying off the original amount of money you borrowed. The interest portion covers the cost of borrowing.

Your mortgage payment will be the same amount each month. Early in the life of the loan, more money goes toward interest than principal. Over time, the principal portion will match and then exceed the interest amount. For example, on a 30-year $200,000 mortgage at 4%, your monthly payment is $955. For the first payment, $288 goes toward principal and $667 goes toward interest. It isn’t until the 153rd payment that the interest and principal are roughly equal. Thereafter, more of the monthly payment goes toward principal until, on the very last payment of the schedule, $952 goes to principal and $3 to interest.

Your lender will provide you with an amortization schedule that shows a month-by-month P&I (principal and interest) breakdown for your loan.

For convenience, many people include property tax and insurance payments in their monthly mortgage payment. Technically, these aren’t part of the loan, but the loan servicer can put this money into an escrow account, where it is saved until the taxes and insurance are due. They then make the payments for you. You are not required to include escrow in your monthly payments. If you choose not to, you will just pay your property taxes and insurance annually on your own.

“Which Loans Are Best for First-Time Buyers?“

Along with conventional loans, the following loans offer distinct advantages for first-time buyers.

- FHA loans. A Federal Housing Administration (FHA) loan is a mortgage that is insured by the Federal Housing Administration (FHA) and issued by an FHA-approved lender such as Mortgage 1. FHA loans are designed for low-to-moderate-income borrowers; they require a lower minimum down payment and lower credit scores than many conventional loans.

- VA loans. VA loans are offered through the Department of Veterans Affairs. They are available to active and veteran service personnel and their families. VA loans are backed by the federal government and issued through private lenders like Mortgage 1. VA loans have favorable terms, such as no down payment, no mortgage insurance, no-prepayment penalties, and limited closing costs.

- USDA loans. Rural Development home loans are low-interest, fixed-rate loans provided by the United States Department of Agriculture. The loans do not require a down payment. The loans are financed by the USDA and obtained through private lenders, such as Mortgage 1, and are meant to promote and support home ownership in underserved areas.

- MSHDA loans. The Michigan State Housing Development Authority (MSHDA) offers down payment assistance to people with no monthly payments. The down payment program offers assistance up to $7,500 (or 4% of the purchase price, whichever is less).

“Can I Complete the Mortgage Process Online?“

Yes! Every Michigan Mortgage loan officer has a Home Snap digital application that allows you to complete the application process online. You can get approved in as little as 15 minutes. The app lets you submit your information, communicate with your loan officer, and track the status of your loan. In these times of COVID and social distancing, Home Snap is the perfect solution.

“What is PMI?“

Private Mortgage Insurance (PMI) is an insurance policy that protects a mortgage lender or title holder if a borrower defaults on payments, passes away, or is otherwise unable to meet the contractual obligations of the mortgage. If you pay 20% or more as a down payment on a conventional loan, you do not need PMI. Once you start paying PMI, it goes away in two ways: (1) once your mortgage balance reaches 78% of the original purchase price; (2) at the halfway point of your amortization schedule. For example, if you have a 30-year loan, the midpoint would be 15 years. At the point, the lender must cancel the PMI then, even if your mortgage balance hasn’t yet reached 78% of the home’s original value. PMI is typically between 0.5% to 1% of the entire loan amount.

“What Do I Need to Bring to Closing?“

Closing is when you sign the many documents that finalize your purchase. The closing is usually held at a title company’s office. The seller will be there, as will your agent. In terms of what you should bring:

- Photo ID: The closing agent has to verify that you are who you say you are. A driver’s license or current passport will do.

- Cashier’s or certified check: This is to cover any down payment and closing costs you owe. Do not bring personal check or cash. Your lender will tell you how much the check should be and who it should be made out to.

- Proof of insurance: The closing agent needs to see proof that you have the insurance in effect on closing day and a receipt showing you’ve paid the policy for a year. They may have already collected that, but it doesn’t hurt to bring your own copy just to ensure things go smoothly.

- Final purchase and sales contract: Just in case you need to double-check anything against the actual closing costs.

“What Happens If My Appraisal is Low?“

When determining the size of your loan, lenders use a formula called loan-to-value (LTV). When your mortgage contract is initially written, LTV is calculated using the purchase price. But the final contract is based upon the official appraised value of the house. What happens if the appraised value comes in lower? You have several options.

- Boost the amount of your down payment. This will allow you to meet the LTV and down payment minimums.

- The seller can lower the price. The seller can agree to drop the sales price of the house to match the appraised value. This will allow you to meet LTV.

- Dispute the appraisal and ask for a new one. If you think the appraiser undervalued the house, you can ask for a new appraisal.

- Cancel the purchase. If a compromise can’t be reached, you can cancel the home purchase agreement.

“What Will Mortgage Rates Be Next Year?“

Ah, if only we had a crystal ball. We can’t predict what mortgage rates will be in a year, but we can say that rates today are near historic lows. The Federal Reserve announced recently that they will be holding short-term interest rates steady for the foreseeable future. While mortgage rates aren’t tied specifically to short-term interest rates, the two generally track closely together. So, while we can’t predict what rates will be in a year, we can say with certainty that today’s rates are at historic lows.

Got Questions? We’ve Got Answers

If you have questions, let us know. At Michigan Mortgage, we specialize in helping first-time buyers understand the mortgage process.

This blog post was written by experts at Mortgage 1 and originally appeared on www.mortgageone.com. Michigan Mortgage is a DBA of Mortgage 1.

What Is MSHDA?

What Is MSHDA?

VA Home Loan Benefits

VA Home Loan Benefits

A real estate appraisal is the process of assigning an objective value for a home.

A real estate appraisal is the process of assigning an objective value for a home.

#2: Know what you can afford

#2: Know what you can afford

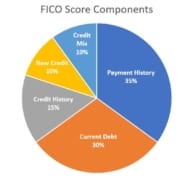

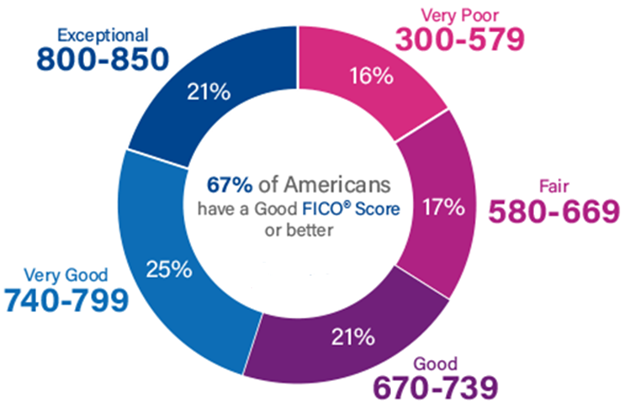

Most people assume that their Credit Karma score is their universal credit score when applying for a home or auto loan. When their true mortgage credit score is pulled by their Loan Officer, shock and anger typically follow. Why are they different? Did the Loan Officer pull the wrong score?

Most people assume that their Credit Karma score is their universal credit score when applying for a home or auto loan. When their true mortgage credit score is pulled by their Loan Officer, shock and anger typically follow. Why are they different? Did the Loan Officer pull the wrong score?

According to MSHDA, “This program was created to offer assistance to purchasers within specific geographic areas where the opportunity to purchase a home is high but the rate of homeownership needs improvement. Homebuyers looking to purchase a home within one of these areas will benefit from additional support to help them achieve homeownership.”

According to MSHDA, “This program was created to offer assistance to purchasers within specific geographic areas where the opportunity to purchase a home is high but the rate of homeownership needs improvement. Homebuyers looking to purchase a home within one of these areas will benefit from additional support to help them achieve homeownership.”

#1. On average, buyers spend 10 weeks searching for a home and view an average of 10 houses.

#1. On average, buyers spend 10 weeks searching for a home and view an average of 10 houses.

For first-time buyers, the mortgage process raises a lot of questions. In part two of this series, we tackle some more of the most common questions we receive from customers.

For first-time buyers, the mortgage process raises a lot of questions. In part two of this series, we tackle some more of the most common questions we receive from customers.