Five Tips to Improve Your Credit Score

Your three-digit credit score can make or break your financial future.

Interested in buying a home? Your credit score will determine whether or not you qualify. Looking to buy a new car or recreational vehicle? Your credit score will determine your interest rate. Hoping to take out a personal loan to invest in your child’s future? You need to have good credit to do so.

If your credit score isn’t up to par, we’re here to help! But before we offer you tips to improve your three-digit score, we want to make sure you understand how your score is calculated.

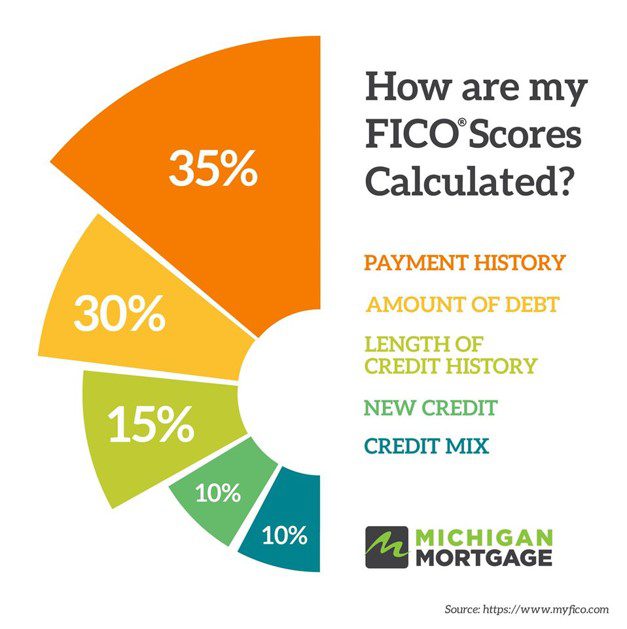

A combination of five factors determines your FICO credit score; some factors impact the score more than others. Take a look at the graph below to better understand.

FICO scores can range from 300 to 850, but for mortgage purposes, your goal should be 680 or above.

Here are five tips to help you reach that 680 benchmark.

- Make sure your credit reports are accurate. Lenders analyze reports from three credit bureaus when you apply for a mortgage – Equifax, TransUnion and Experian. If you don’t have a copy of your reports, you can claim a free report from each bureau once every 12 months at annualcreditreport.com. Mistakes are known to happen, and reporting errors can have a negative impact on your score. If you find a credit reporting error, dispute the mistakes with the appropriate credit reporting agency and your score may improve.

- Make your payments on time. According to experts, a large portion of your credit score (35 percent, to be exact) is calculated based on payment history. Making your payments on time, every time can greatly impact your score. This includes credit card bills or any loans you may have, such as auto loans or student loans, your rent, utilities, phone bill and so on.

- Reduce the amount you owe. Roughly 30 percent of your credit score is calculated based on the amount of debt you owe. Most loan programs have very specific debt-to-income ratios in place that can keep you from purchasing your dream home. For the ultimate credit score boost, credit experts suggest you pay on time, twice per month, and decrease the amount you owe. This will help control the factors that collectively make up 65 percent of your score.

- Become an authorized user on someone else’s credit card account. This is easier said than done, but if your spouse or parent has excellent credit and a perfect payment history, it would benefit you (and improve your credit score) if you were added as an authorized user on their credit card account. Why? The account will show up on your credit report as well as the credit utilization rate and all the on-time payments associated with the account, which will naturally increase your score.

- Open a secure credit card. Opening a secure credit card, and using it properly, can help to increase your credit score. You’ll be required to deposit money into a checking account to secure the line of credit. Payments will come directly out of this account, so they will always be on time and will never be missed.

Your credit score won’t improve over night, but with a little hard work and dedication, you’ll be moving into your dream home in no time.

It is important for you to analyze your spending habits. If you do not have a budget, you should start one now. This will help you understand you spending habits so that the lifestyle that is important to you will be maintainable as a homeowner.

It is important for you to analyze your spending habits. If you do not have a budget, you should start one now. This will help you understand you spending habits so that the lifestyle that is important to you will be maintainable as a homeowner.

So, what is the best use of those funds? Like most questions, the answers vary depending on the individual situation. If you are swimming in debt it may be time to pay some of that debt off. If you have not funded your 401(k) for the year, perhaps that money is best used to invest in a tax deferred plan.

So, what is the best use of those funds? Like most questions, the answers vary depending on the individual situation. If you are swimming in debt it may be time to pay some of that debt off. If you have not funded your 401(k) for the year, perhaps that money is best used to invest in a tax deferred plan.

Home Equity at All-Time High

Home Equity at All-Time High

However, for many lenders, that’s not enough to be considered a good mortgage candidate. As a borrower, your DTI is utilized in various situations to determine your level of risk. For instance, if your DTI is too high, opportunities to make a big purchase, such as a mortgage, may be limited.

However, for many lenders, that’s not enough to be considered a good mortgage candidate. As a borrower, your DTI is utilized in various situations to determine your level of risk. For instance, if your DTI is too high, opportunities to make a big purchase, such as a mortgage, may be limited.

Appraisals are required as past of the home-buying process. Home inspections are not, but they may be one of the most beneficial things you can do for your financial future. A home inspection will ensure that you don’t buy a money pit.

Appraisals are required as past of the home-buying process. Home inspections are not, but they may be one of the most beneficial things you can do for your financial future. A home inspection will ensure that you don’t buy a money pit.

Conventional loans refer to it as PMI (Private Mortgage Insurance) whereas FHA and Rural Development (RD) refer to it as MIP (mortgage insurance premium). VA does not have it at all but they have a funding fee on most loans that is added to the principal balance. FHA and RD have a similar add on fee that is called upfront mortgage insurance.

Conventional loans refer to it as PMI (Private Mortgage Insurance) whereas FHA and Rural Development (RD) refer to it as MIP (mortgage insurance premium). VA does not have it at all but they have a funding fee on most loans that is added to the principal balance. FHA and RD have a similar add on fee that is called upfront mortgage insurance.

Online Applications Make a Mortgage Easier

Online Applications Make a Mortgage Easier

Focus on the Exterior

Focus on the Exterior

“I purchased my home about five years ago when the market was hot and prices were much lower than they are today,” Dan said. “It was a bank foreclosure and needed some work, so shortly after the purchase I took out a home equity line of credit to make repairs and updates such as a new furnace, water heater, plumbing work, electrical and some cosmetic upgrades.”

“I purchased my home about five years ago when the market was hot and prices were much lower than they are today,” Dan said. “It was a bank foreclosure and needed some work, so shortly after the purchase I took out a home equity line of credit to make repairs and updates such as a new furnace, water heater, plumbing work, electrical and some cosmetic upgrades.”