MSHDA Increases Sales Price Limit – What Does That Mean for You?

Michigan homebuyers, take note — big changes are coming that could make purchasing a home more achievable than ever. Beginning in May 2025, the Michigan State Housing Development Authority (MSHDA) will raise its maximum sales price limit for the first time in over 16 years. Thanks to the passage of HB 5032, this update opens new doors for buyers across the state.

Here’s what you need to know — and how this change could work in your favor.

What’s Changing?

Higher Sales Price Limits

MSHDA’s new guidelines will increase the maximum sales price for eligible single-family homes from $224,500 to $544,233. This significant jump gives homebuyers access to a broader range of properties throughout Michigan, including many that were previously out of reach.

Expanded Eligibility

MSHDA programs have historically been geared toward first-time homebuyers, but that’s changing. Beginning next May, repeat buyers will also be eligible for MSHDA assistance in 82 percent of Michigan counties. This expansion means more buyers, regardless of where they are in their homeownership journey, will be able to take advantage of MSHDA programs.

Flexible Loan Compatibility

MSHDA programs can be paired with a variety of popular loan types, including Conventional, FHA, VA, and RD (Rural Development) loans. This added flexibility allows more buyers to find financing solutions tailored to their specific needs.

Need more information? Fill out this form and our team will be in touch soon!

How This Helps You

Access to More Inventory

The increased price cap opens the door to a larger pool of available homes — giving you more options in more locations and helping you find a home that truly fits your lifestyle and budget.

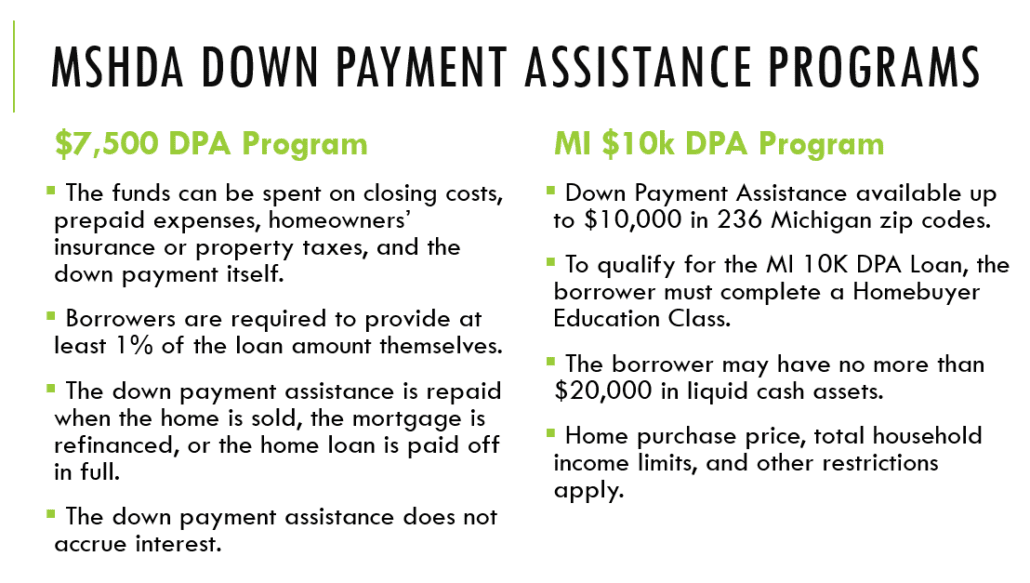

Up to $10,000 in Down Payment Assistance

MSHDA’s MI Home Loan DPA program offers up to $10,000 to help cover your down payment and closing costs. This can be a game-changer for buyers looking to make a competitive offer without depleting their savings.

Ongoing Tax Savings

Through MSHDA’s Mortgage Credit Certificate (MCC) program, eligible buyers can receive a federal tax credit worth up to $2,000 annually, based on mortgage interest paid. This benefit boosts affordability and adds value for years to come.

Simple, Streamlined Financing

Because MSHDA works seamlessly with a range of loan types, the financing process remains straightforward. And when you work with an experienced lender like Michigan Mortgage, you have a trusted partner guiding you through every step.

What Should You Do Now?

Start Looking at Homes

Explore neighborhoods and listings that will fall within the new sales price limits. With more homes potentially in reach, it’s a great time to refine your search.

Reach Out to Michigan Mortgage

Our team is well-versed in MSHDA programs and how they work. We can help you navigate the changes, understand your eligibility, and secure the right loan for your needs.

Stay Updated

The new sales price limits are expected to take effect in May 2025, once HUD releases updated income guidelines and the IRS announces new safe harbor limits in April. We’ll keep you informed with everything you need to know as the changes roll out.

Final Thoughts

MSHDA’s updated guidelines represent a major win for Michigan homebuyers. Whether you’re purchasing your first home or transitioning to your next, the increased sales price limits and expanded eligibility open the door to more opportunity — and more homes.

At Michigan Mortgage, we’re committed to helping you make the most of it. If you’re ready to learn more or begin your home search, contact us today. We’re here to help you move forward with confidence!

The U.S. Department of the Treasury notified MSHDA on April 14, 2021, that it will allocate $242,812,277 to the State of Michigan. This number was based on unemployed individuals and the number of mortgagors with delinquent mortgage payments.”

The U.S. Department of the Treasury notified MSHDA on April 14, 2021, that it will allocate $242,812,277 to the State of Michigan. This number was based on unemployed individuals and the number of mortgagors with delinquent mortgage payments.”

What Is MSHDA?

What Is MSHDA?

According to MSHDA, “This program was created to offer assistance to purchasers within specific geographic areas where the opportunity to purchase a home is high but the rate of homeownership needs improvement. Homebuyers looking to purchase a home within one of these areas will benefit from additional support to help them achieve homeownership.”

According to MSHDA, “This program was created to offer assistance to purchasers within specific geographic areas where the opportunity to purchase a home is high but the rate of homeownership needs improvement. Homebuyers looking to purchase a home within one of these areas will benefit from additional support to help them achieve homeownership.”

Take it right out of your paycheck and transfer a fixed amount into a special savings account. This is probably the most convenient and practical way to save. Take it right out of your paycheck. Make sure you set up an automatic direct deposit into a savings account that is earmarked for your down payment only. Commit to using this money for a down payment and no other purpose.

Take it right out of your paycheck and transfer a fixed amount into a special savings account. This is probably the most convenient and practical way to save. Take it right out of your paycheck. Make sure you set up an automatic direct deposit into a savings account that is earmarked for your down payment only. Commit to using this money for a down payment and no other purpose.

We’re happy to introduce the program because, unlike the current MSHDA down payment assistance program, it’s a forgivable loan. In five years, if the borrower still occupies the home as their primary residence, the loan is completely forgiven. The loan is forgiven 20 percent each year until the five-year mark is reached.

We’re happy to introduce the program because, unlike the current MSHDA down payment assistance program, it’s a forgivable loan. In five years, if the borrower still occupies the home as their primary residence, the loan is completely forgiven. The loan is forgiven 20 percent each year until the five-year mark is reached.