Why a Doctor Loan?

For a new physician excited about the possibility of buying a home but carrying the weight of heavy student debt, a physician mortgage can be a great springboard for entering the housing market.

The physician loan (also known as a doctor loan) is designed to help a unique population that often has a high amount of student loan debt and minimal savings, as well as a new job contract that is required by lenders.

These loans are available for doctors, dentists, podiatrists, ophthalmologists and veterinarians.

The main advantages of doctor loans are access to financing with little to no money down and no required private mortgage insurance.

For new physicians, doctor loans offer a fast path to home ownership that would not be available otherwise. Last year, 84 percent of graduates from medical school reported having student loan debt; the median amount was $190,000 (according to the American Association of Medical Colleges).

Here’s a list of the program highlights.

- 15-year fixed

- No Mortgage Insurance

- Loan amount up to $650,000

- Minimum Credit Score: 700

- Not available for Construction Loans

- Not available for investment properties, second home or manufactured housing

- Maximum 50 percent debt-to-income ratios

The perks of doctor loans are appealing for medical professionals who are ready to settle down after the grueling years in medical school and residency.

Physician loans are not a on size fits all option. It is important to sit down with a trusted mortgage professional and consider your individual situation to decide whether or not one is right for you.

For more information about doctor loans, visit www.michmortgage.com or contact one of loan officers. We’re here to help.

We’re happy to introduce the program because, unlike the current MSHDA down payment assistance program, it’s a forgivable loan. In five years, if the borrower still occupies the home as their primary residence, the loan is completely forgiven. The loan is forgiven 20 percent each year until the five-year mark is reached.

We’re happy to introduce the program because, unlike the current MSHDA down payment assistance program, it’s a forgivable loan. In five years, if the borrower still occupies the home as their primary residence, the loan is completely forgiven. The loan is forgiven 20 percent each year until the five-year mark is reached.

Here’s what Eric Ridlington, owner of Prestige Appraisal Service, had to say about the process.

Here’s what Eric Ridlington, owner of Prestige Appraisal Service, had to say about the process.

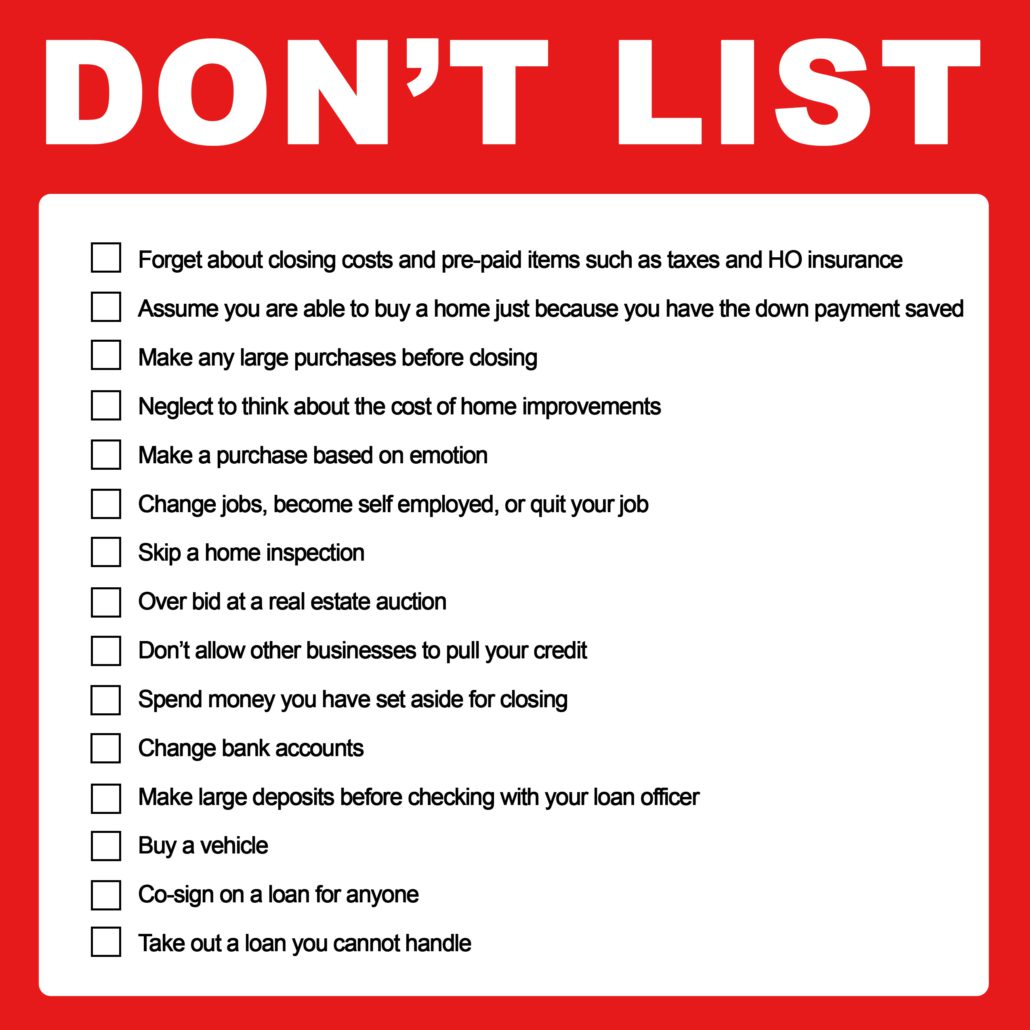

In what is called “a seller’s market” multiple offers are being made days and sometimes hours after a property is listed on the market. We have seen purchase agreements that are tens of thousands of dollars more than list price.

In what is called “a seller’s market” multiple offers are being made days and sometimes hours after a property is listed on the market. We have seen purchase agreements that are tens of thousands of dollars more than list price.

Ryan Hendrickson: I would recommend getting a quote as soon as an offer has been accepted. When purchasing a home, especially in this seller’s climate, a speedy close is often a requirement of the offer. If you’re able to finalize your homeowners insurance early in the process, you will insure that it will not cause any unnecessary delays in your loan closing.

Ryan Hendrickson: I would recommend getting a quote as soon as an offer has been accepted. When purchasing a home, especially in this seller’s climate, a speedy close is often a requirement of the offer. If you’re able to finalize your homeowners insurance early in the process, you will insure that it will not cause any unnecessary delays in your loan closing.

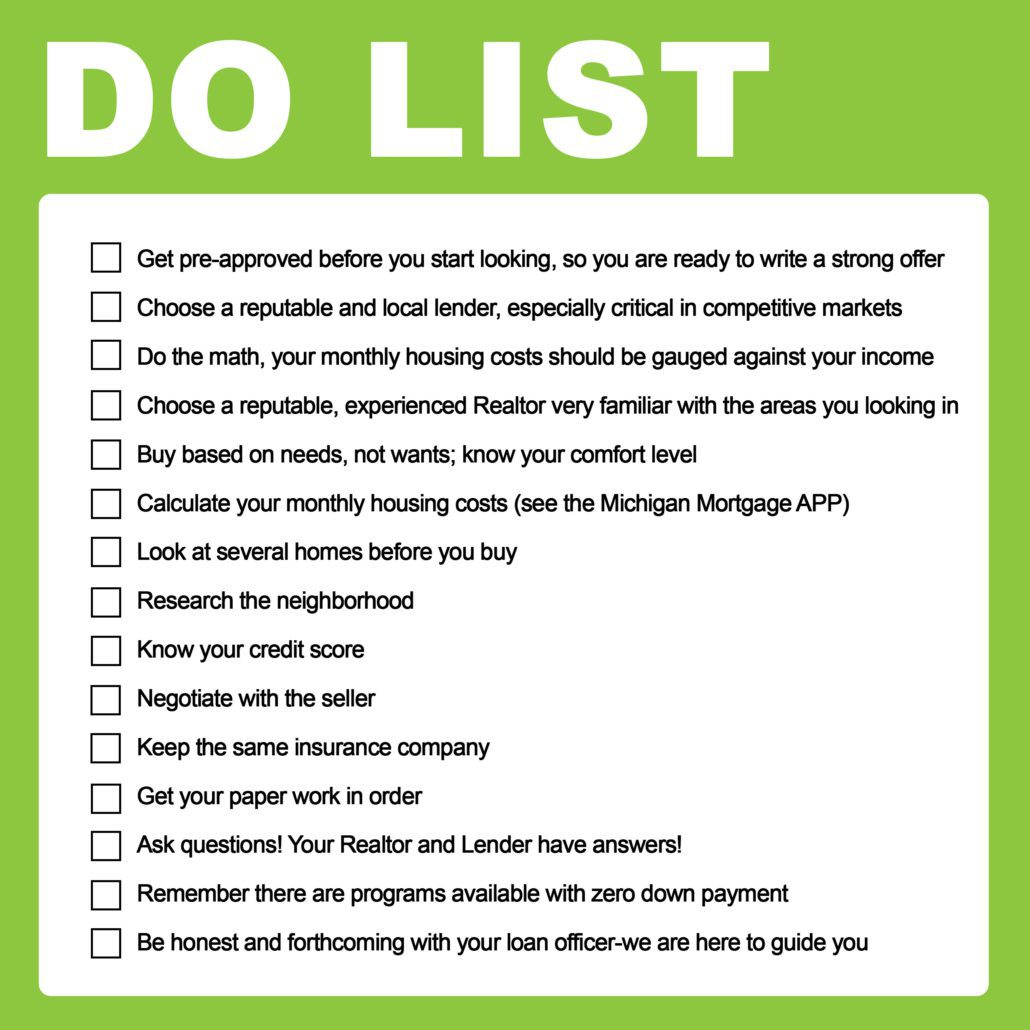

Without a mortgage from a reputable and trusted lender, you may not get a house in today’s market. While shopping with a reputable realtor is important, make sure you allot the time and attention to your home loan first.

Without a mortgage from a reputable and trusted lender, you may not get a house in today’s market. While shopping with a reputable realtor is important, make sure you allot the time and attention to your home loan first.

“In a housing market where bidding wars are common, buyers who need financing can strengthen their offers by working with a locally based mortgage broker or loan officer,” said David Riemersma,

“In a housing market where bidding wars are common, buyers who need financing can strengthen their offers by working with a locally based mortgage broker or loan officer,” said David Riemersma,