Tips that Make Getting a Mortgage a Breeze in 2019

Tip #1: Start early. One of the most important mortgage tips you should know before you get started is to understand all of your financial details. This makes the mortgage process go much more smoothly and eliminates surprises throughout the process.

Tip #2: Check your credit report for errors. Review your credit report to ensure that there are no errors such as incorrect addresses, phone numbers, names or accounts that show up. Your mortgage lender can give you the most detailed credit overview. There are multiple online sources that will provide a free credit report as well.

Tip #3: Work with a qualified lender before making repairs to your credit score on your own. A professional will consult you so that you don’t end up inadvertently lowering your score by trying to repair it on your own.

Tip #3: Work with a qualified lender before making repairs to your credit score on your own. A professional will consult you so that you don’t end up inadvertently lowering your score by trying to repair it on your own.

Tip #4: You can avoid private mortgage insurance if you have 20 percent down. If you do not have 20 percent down, there are multiple loan programs available that require a lower down payment. Your credit score and other variables come into play, so it’s not a one-size-fits-all process.

Tip #5: Make sure you can afford the payment comfortably. Most mortgages have a debt-to-income (DTI) ratio requirement. The DTI is the amount of monthly debt payments you have compared to your monthly income. Most mortgages will allow a maximum DTI of 41 percent; however, this number is not the same for every borrower nor for every loan. Ideally, you want to be comfortable and not stretch yourself too thin so you still have cash on reserve.

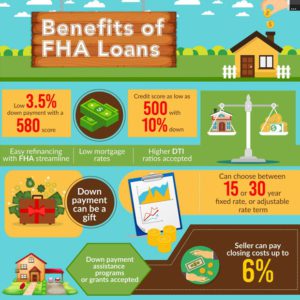

Tip #6: Know the right kind of loan for your unique situation. There are multiple loan options available. With conventional, FHA, rural development, VA, doctor loans and MSHDA options, as well as the streamlined 203(k) program, there are numerous nuances and options available to meet every borrower’s unique situation. Make sure you work with a knowledgeable loan officer that will take the time to educate you.

Tip #7: Have your documents ready so you don’t slow down the loan process. The mortgage process requires a great amount of paperwork, so having as much documentation beforehand can save time and energy. A loan officer will need to verify your income, tax documents, employment and a slew of other things.

Here is a checklist of some of the documents you may need (not all will apply to your unique situation).

- Bank statements

- Tax returns from the previous two years

- W2s from past and current employers

- Pay stubs

- A list of your debts

- A list of your assets

- A gift letter if you’re using gift funds

- Proof of timely rental payments

- Credit Report

- Profit and loss statements

- Signed purchase agreement

- Proof of additional income

- Divorce decree

- Bankruptcy paperwork

Depending on the loan and your credit history, you may need additional documentation not listed above. To better understand the process and be the most prepared, reach out to your trusted loan officer. We’re always here to help.

1. Plan ahead. Before you begin saving for a down payment for a home, you first need to know approximately how much you will have to save. Plan to sit down with a mortgage lender who will let you know what you qualify for.

1. Plan ahead. Before you begin saving for a down payment for a home, you first need to know approximately how much you will have to save. Plan to sit down with a mortgage lender who will let you know what you qualify for.

“Before applying for a mortgage, clients really need to understand the importance of having established credit and having a good credit score,” said Jill Dobb, loan officer assistant at Michigan Mortgage. “Buying a home requires you to have credit and the better the credit score the better the interest rate you will qualify for.”

“Before applying for a mortgage, clients really need to understand the importance of having established credit and having a good credit score,” said Jill Dobb, loan officer assistant at Michigan Mortgage. “Buying a home requires you to have credit and the better the credit score the better the interest rate you will qualify for.”

As interest rates continue to rise and the market becomes more volatile, it is more important than ever that your interest rate is locked at the right time. So, when is the right time to lock? This article will discuss what goes into deciding when, and under what circumstances your loan should be locked.

As interest rates continue to rise and the market becomes more volatile, it is more important than ever that your interest rate is locked at the right time. So, when is the right time to lock? This article will discuss what goes into deciding when, and under what circumstances your loan should be locked.

We’re happy to introduce the program because, unlike the current MSHDA down payment assistance program, it’s a forgivable loan. In five years, if the borrower still occupies the home as their primary residence, the loan is completely forgiven. The loan is forgiven 20 percent each year until the five-year mark is reached.

We’re happy to introduce the program because, unlike the current MSHDA down payment assistance program, it’s a forgivable loan. In five years, if the borrower still occupies the home as their primary residence, the loan is completely forgiven. The loan is forgiven 20 percent each year until the five-year mark is reached.

Here’s what Eric Ridlington, owner of Prestige Appraisal Service, had to say about the process.

Here’s what Eric Ridlington, owner of Prestige Appraisal Service, had to say about the process.

In what is called “a seller’s market” multiple offers are being made days and sometimes hours after a property is listed on the market. We have seen purchase agreements that are tens of thousands of dollars more than list price.

In what is called “a seller’s market” multiple offers are being made days and sometimes hours after a property is listed on the market. We have seen purchase agreements that are tens of thousands of dollars more than list price.