Tips for Buyers in a Seller’s Market

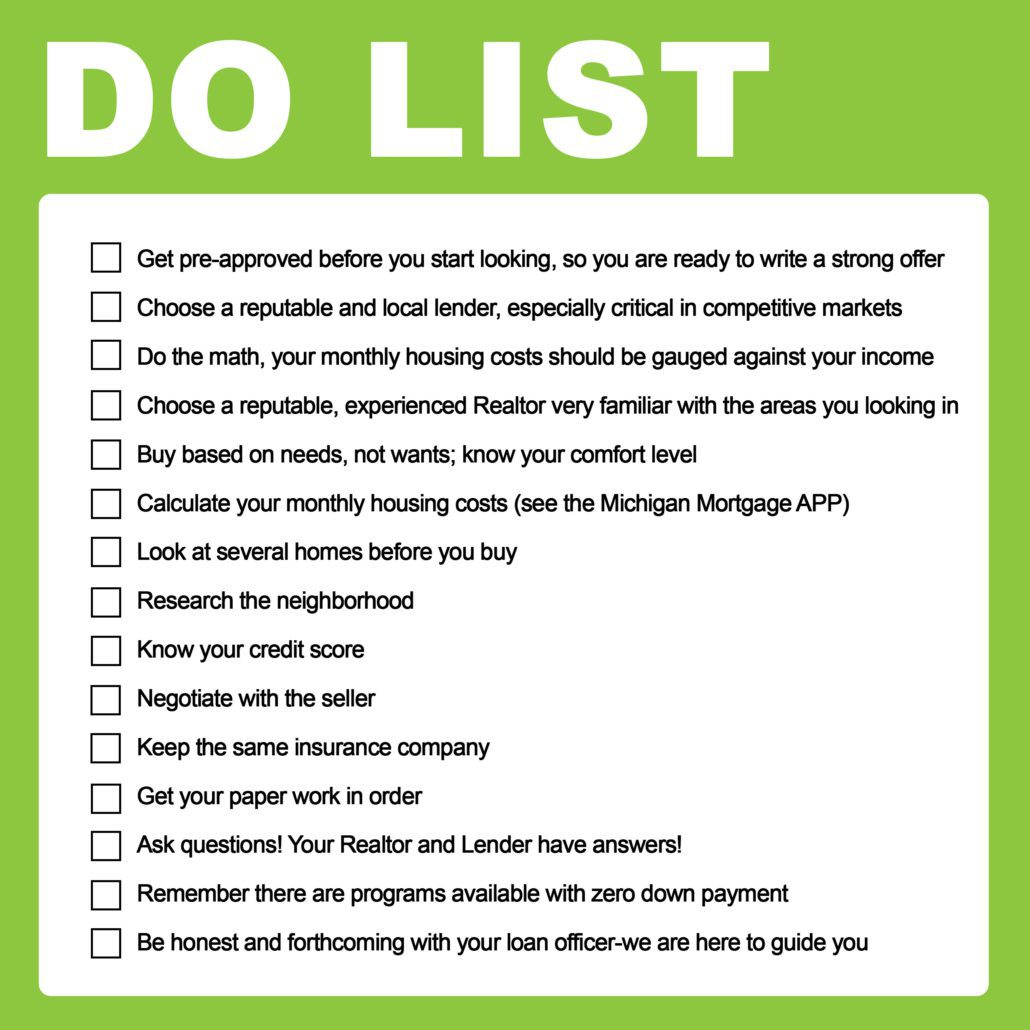

Don’t let your dream home slip through your fingers. A solid pre-approval letter will give you a leg up.

Getting preapproved and having a dependable, air-tight written pre-approval from a respectable lender could never be more important than it is today.

In what is called “a seller’s market” multiple offers are being made days and sometimes hours after a property is listed on the market. We have seen purchase agreements that are tens of thousands of dollars more than list price.

In what is called “a seller’s market” multiple offers are being made days and sometimes hours after a property is listed on the market. We have seen purchase agreements that are tens of thousands of dollars more than list price.

This seller’s market has created some unique challenges that serious buyers need to be prepared for.

1. Standing out among the crowd. Anytime you have a competitive situation, you want your offer to stand out among all the others. The best way to do this is to submit your pre-approval letter with the offer. At a minimum, the pre-approval letter should tell the seller that the lender has reviewed your credit, income and assets.

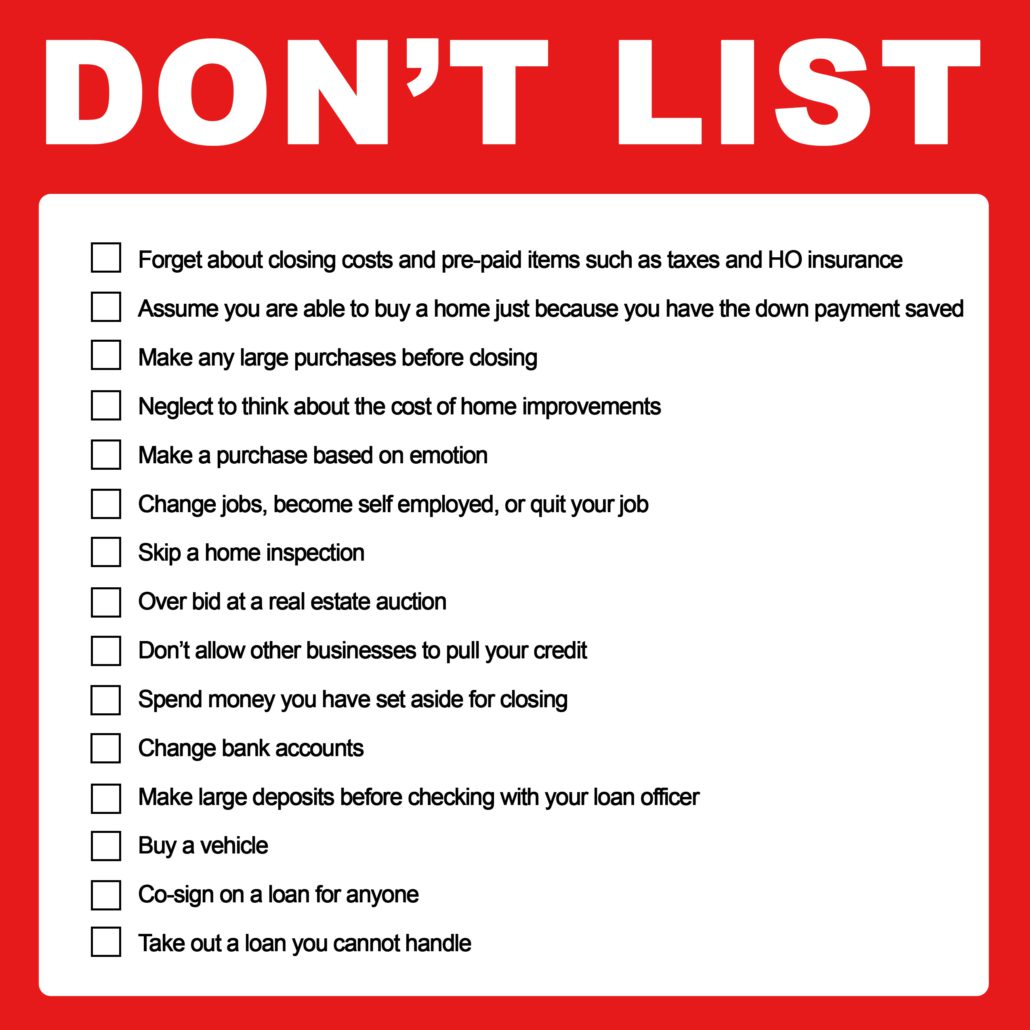

2. Seller concessions. For a long time, seller concessions (i.e. a clause where the seller contributes to the buyers closing costs and prepaid costs) have been common place. However, in this market, sellers are getting more reluctant to except those terms. Aside from this reducing the net proceeds to the seller, sellers understand that many appraisals are not coming in at the contract price. Until comparable sales catch up with the market, this may prove to be an issue.

3. Large earnest money deposit. Another attractive strategy for buyers is to put down a large earnest money deposit. This says to the seller that you are serious about their house and are willing to put money on the table. If The buyer decides to walk away from this agreement, they would lose those funds. I have also recently seen buyers agree to have an earnest money deposit being non-refundable for any reason if buyer does not obtain financing.

4. Quick close date. Buyers are offering to close their transaction faster than other offers. This is attractive to a seller that is trying to purchase another property. Unfortunately, those promises are dependent on more than just the lender. To get from start to finish on a closing, there must be cooperation from appraisers, title companies, realtors, borrowers, sellers, as well as the lender. Nevertheless, in this market it has never been more important to have a lender that has all of their ducks in a row so that the buyer can get to the closing table as quickly as possible.

5. The added phone call. For many of my clients, I will personally call the listing agent after I send a pre-approval letter to let them know that this buyer is good to go. It’s amazing how far that will go to get your offer excepted.

6. Out of town or unknown lender. I’ve heard multiple realtors tell me that they do not except pre-approval letters from lenders they are not familiar with. Right or wrong, this is an important reason to get approved from a local reputable lender.

In a market where your pre-approval is more important than ever, it is imperative that borrowers connect early and thoroughly with the right lender. We’re here to help!

Ryan Hendrickson: I would recommend getting a quote as soon as an offer has been accepted. When purchasing a home, especially in this seller’s climate, a speedy close is often a requirement of the offer. If you’re able to finalize your homeowners insurance early in the process, you will insure that it will not cause any unnecessary delays in your loan closing.

Ryan Hendrickson: I would recommend getting a quote as soon as an offer has been accepted. When purchasing a home, especially in this seller’s climate, a speedy close is often a requirement of the offer. If you’re able to finalize your homeowners insurance early in the process, you will insure that it will not cause any unnecessary delays in your loan closing.

Without a mortgage from a reputable and trusted lender, you may not get a house in today’s market. While shopping with a reputable realtor is important, make sure you allot the time and attention to your home loan first.

Without a mortgage from a reputable and trusted lender, you may not get a house in today’s market. While shopping with a reputable realtor is important, make sure you allot the time and attention to your home loan first.

“In a housing market where bidding wars are common, buyers who need financing can strengthen their offers by working with a locally based mortgage broker or loan officer,” said David Riemersma,

“In a housing market where bidding wars are common, buyers who need financing can strengthen their offers by working with a locally based mortgage broker or loan officer,” said David Riemersma,

1. Zero down. Purchasing a home with no out-of-pocket money can sometimes mean the difference of being able to buy now or having to wait. For some, a zero-down option is the only way that they can ever purchase a home if they are on a fixed income. For others it is a way they can save their money for home improvements or other investments. Regardless of the reason, the VA loan is one of the few loans that allows a zero-down option.

1. Zero down. Purchasing a home with no out-of-pocket money can sometimes mean the difference of being able to buy now or having to wait. For some, a zero-down option is the only way that they can ever purchase a home if they are on a fixed income. For others it is a way they can save their money for home improvements or other investments. Regardless of the reason, the VA loan is one of the few loans that allows a zero-down option.

Whether you’re in the red or in the green, your credit score is key.

Whether you’re in the red or in the green, your credit score is key.