Can you get a mortgage with no credit?

Sometimes young clients who have not established credit are interested in getting home financing. Other times, clients who have never taken out any credit and pay cash for everything decide it is time to buy but don’t have enough cash.

How did those folks get into a home loan?

With most sub-prime loans going by the wayside, options for these people are limited but not completely closed.

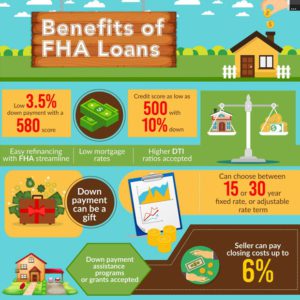

FHA has a no credit loan when a borrower has no credit score but can prove a 12-month pay history on three lines of non-traditional credit.

FHA has a no credit loan when a borrower has no credit score but can prove a 12-month pay history on three lines of non-traditional credit.

For example, if someone has utility bills, car insurance, rent, or even something like Netflix, they may be able to get financing. We simply have to get the pay history from the creditor to show they have been on time for 12 months. Note that if they have any derogatory credit like collections, they can negate this option.

Oftentimes, clients with no score also have no non-tradition credit they can add. These clients will need to establish a score. This is not as difficult as it sounds.

If they cannot get a traditional credit card, they may be able to get a secured credit card. Most banks and credit unions will give a credit card that is secured by cash. There may be a minimum amount required, but usually $300 deposited with the bank can secure a card. The consumer then uses that card just like any other credit card to establish credit. This will take about six months and will be good credit for them as long as the balance is under 30 percent of the high credit limit when credit is pulled.

Pitfalls: Many people think that paying off derogatory credit (like collections) or closing out accounts with late payments is s good thing. While this may be the right thing to do, it may not help their score. Having new activity on a derogatory account can often LOWER the score!

Every situation is unique. That is why a consultation with a knowledgeable advisor is the best course of action. Call us for more details on how to establish credit and what is not advisable given your situation.

It all started many, many years ago. In third grade, in fact. Long before Rob Garrison was a licensed Loan Officer, he spent his days on the playground with Brian Fredricks. A friendship was born and it has lasted for nearly half a century.

It all started many, many years ago. In third grade, in fact. Long before Rob Garrison was a licensed Loan Officer, he spent his days on the playground with Brian Fredricks. A friendship was born and it has lasted for nearly half a century.

“Buying a home is a serious investment,” said Loan Officer Rob Garrison. “Before you start shopping home listings, it is important to sit back, do your homework and analyze your personal and financial goals as well as your lifestyle before you take the plunge.”

“Buying a home is a serious investment,” said Loan Officer Rob Garrison. “Before you start shopping home listings, it is important to sit back, do your homework and analyze your personal and financial goals as well as your lifestyle before you take the plunge.”

Tip #3:

Tip #3:

1. Plan ahead. Before you begin saving for a down payment for a home, you first need to know approximately how much you will have to save. Plan to sit down with a mortgage lender who will let you know what you qualify for.

1. Plan ahead. Before you begin saving for a down payment for a home, you first need to know approximately how much you will have to save. Plan to sit down with a mortgage lender who will let you know what you qualify for.

“Before applying for a mortgage, clients really need to understand the importance of having established credit and having a good credit score,” said Jill Dobb, loan officer assistant at Michigan Mortgage. “Buying a home requires you to have credit and the better the credit score the better the interest rate you will qualify for.”

“Before applying for a mortgage, clients really need to understand the importance of having established credit and having a good credit score,” said Jill Dobb, loan officer assistant at Michigan Mortgage. “Buying a home requires you to have credit and the better the credit score the better the interest rate you will qualify for.”

Here’s what Eric Ridlington, owner of Prestige Appraisal Service, had to say about the process.

Here’s what Eric Ridlington, owner of Prestige Appraisal Service, had to say about the process.

In what is called “a seller’s market” multiple offers are being made days and sometimes hours after a property is listed on the market. We have seen purchase agreements that are tens of thousands of dollars more than list price.

In what is called “a seller’s market” multiple offers are being made days and sometimes hours after a property is listed on the market. We have seen purchase agreements that are tens of thousands of dollars more than list price.