Mistakes to Avoid When Shopping for a New Home

Shopping for a new home can be one of the greatest experiences of a lifetime! When you venture out to purchase a home, make sure you set yourself up for success and an amazing experience.

Avoid these common mistakes:

Not having your financing in order when you are ready to make an offer. It is critical to have a pre-approval from a trusted lender. Especially in a low inventory, competitive market, the buyer who has financing in place is ready to write the offer and “win” the home. So, don’t put yourself in the position of falling in love with a home that you aren’t able to bid on quickly!

Not having your financing in order when you are ready to make an offer. It is critical to have a pre-approval from a trusted lender. Especially in a low inventory, competitive market, the buyer who has financing in place is ready to write the offer and “win” the home. So, don’t put yourself in the position of falling in love with a home that you aren’t able to bid on quickly!- Not taking the time to educate yourself by window shopping and researching the market. Noel Berg with At Home Realty says, “A critical step in home buying is going to Open Houses, driving through neighborhoods and having a Realtor who educates you on home values so that you feel comfortable and confident when you find THE home! The more properties you can visit, the more confident you feel making an offer!”

- Submitting a low-ball offer. Make sure you look at all of the variables before making a low-ball offer. How long has the home been on the market? If it’s a seller’s market, it’s probably off the table. Does the house need updates, making it over priced? Your Realtor can craft an offer that won’t be too aggressive or offensive in the current market.

- Including too many contingencies. Contingencies are basically “walk away” clauses. It is important to protect your own interests, but, typically, the more contingencies in your offer, the less enthusiastic the seller may be to deal with you, especially in a seller’s market. Your Realtor will guide you as to which contingencies are the most critical to protect your interests.

- Using the seller’s agent. A real estate agent’s loyalties and responsibilities change depending on the transaction. A seller’s agent works for the seller to get the highest amount of money in the shortest period of time. Their fiduciary responsibility is to the seller at all times. The buyer’s agent works with the buyer to teach their clients about the market, to show them houses, and advise them when it comes time to make an offer and negotiate with the seller.

- Blindly listening to friends and family members. Though your friends and family have your best interests at heart, unless they are a Realtor, they are simply not experts; often times offering inaccurate and incorrect advice.

- Buying a home that is too expensive. Many buyers get their pre-approval letter and set out to look at houses at the top of the price range without thinking it through. It is important to work through a budget, and evaluate your spending habits and the increased cost of owning a home.

- Letting your emotions guide you. Purchasing a home will likely be one of the biggest and most important purchases in your lifetime. So, it makes sense that there will be emotions, concerns and questions weighing on you during the process. Make sure you take the top seven guidelines seriously so that you are empowered by logic, market awareness and professional advice!

A professional lender and Realtor will guide you home with confidence and authority.

The 3 percent down payment option is similar to existing conventional loan programs with much higher requirements. This program, however, can better serve first-time homebuyers because of the following.

The 3 percent down payment option is similar to existing conventional loan programs with much higher requirements. This program, however, can better serve first-time homebuyers because of the following.

Take it right out of your paycheck and transfer a fixed amount into a special savings account. This is probably the most convenient and practical way to save. Take it right out of your paycheck. Make sure you set up an automatic direct deposit into a savings account that is earmarked for your down payment only. Commit to using this money for a down payment and no other purpose.

Take it right out of your paycheck and transfer a fixed amount into a special savings account. This is probably the most convenient and practical way to save. Take it right out of your paycheck. Make sure you set up an automatic direct deposit into a savings account that is earmarked for your down payment only. Commit to using this money for a down payment and no other purpose.

“I had been renting for about five years and Paul had purchased his first home a few years prior,” Bianca said. “We got engaged and started putting our lives together in the Spring of 2016 and together decided to put his home up for sale with the goal of purchasing a new home in early 2017.”

“I had been renting for about five years and Paul had purchased his first home a few years prior,” Bianca said. “We got engaged and started putting our lives together in the Spring of 2016 and together decided to put his home up for sale with the goal of purchasing a new home in early 2017.”

FHA has a no credit loan when a borrower has no credit score but can prove a 12-month pay history on three lines of non-traditional credit.

FHA has a no credit loan when a borrower has no credit score but can prove a 12-month pay history on three lines of non-traditional credit.

For many home owners who want to use their equity to pay off debt, start a business, invest in the market, or just use the money for purchases, they cannot unless they take out another loan. The two most popular ways to do this is with a home equity line of credit (HELOC) or a cash-out refinance.

For many home owners who want to use their equity to pay off debt, start a business, invest in the market, or just use the money for purchases, they cannot unless they take out another loan. The two most popular ways to do this is with a home equity line of credit (HELOC) or a cash-out refinance.

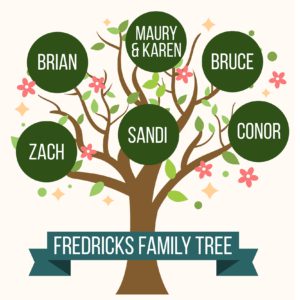

It all started many, many years ago. In third grade, in fact. Long before Rob Garrison was a licensed Loan Officer, he spent his days on the playground with Brian Fredricks. A friendship was born and it has lasted for nearly half a century.

It all started many, many years ago. In third grade, in fact. Long before Rob Garrison was a licensed Loan Officer, he spent his days on the playground with Brian Fredricks. A friendship was born and it has lasted for nearly half a century.

“Buying a home is a serious investment,” said Loan Officer Rob Garrison. “Before you start shopping home listings, it is important to sit back, do your homework and analyze your personal and financial goals as well as your lifestyle before you take the plunge.”

“Buying a home is a serious investment,” said Loan Officer Rob Garrison. “Before you start shopping home listings, it is important to sit back, do your homework and analyze your personal and financial goals as well as your lifestyle before you take the plunge.”

The Realtors priority is to help set the right price and then get buyers in the door. Agents have access to the most up-to-date information regarding recent sales of comparable homes and competing homes in your neighborhood. You may know that a home down the street was on the market for $350,000, but an agent will know if that home had upgrades and sold at $285,000 after 65 days on the market and after it fell out of escrow three times.

The Realtors priority is to help set the right price and then get buyers in the door. Agents have access to the most up-to-date information regarding recent sales of comparable homes and competing homes in your neighborhood. You may know that a home down the street was on the market for $350,000, but an agent will know if that home had upgrades and sold at $285,000 after 65 days on the market and after it fell out of escrow three times.

1. Deferring student loans or getting an income-based repayment plan. Student loans are not designed to hamstring people to the point that they cannot afford to own a home. There are several programs available that allow student loan debt to be temporarily deferred or lower the monthly payment based on income.

1. Deferring student loans or getting an income-based repayment plan. Student loans are not designed to hamstring people to the point that they cannot afford to own a home. There are several programs available that allow student loan debt to be temporarily deferred or lower the monthly payment based on income.